"People are suffering. You don’t request credit until you are hungry, until you are suffering. But then you will go and take credit. There are many debts in these shops. Certainly, people disturb these shopkeepers when they borrow money to eat. But it is only hunger or sickness that makes one do such a thing."

- Sudanese shop owner, Kakuma refugee camp

While humanitarian assistance to refugees has increasingly focused on fostering self-reliance, refugees are highly exposed to economic shocks that make self-reliance difficult to achieve. With limited access to employment and low wages, refugees are rarely able to put aside savings in case of emergency. Those who have recently fled their country of origin may have no assets to sell if needed. Informal social protection mechanisms may be unavailable or less effective in contexts of mass displacement where existing networks are disrupted and vulnerability becomes widespread. Given these constraints, borrowing is often the only coping strategy available to refugees.

Based on quantitative and qualitative data collected over a one-year period (October 2022 - November 2023), this report studies how debt is used as a coping strategy by refugees living in Kakuma refugee camp and the Kalobeyei settlement in Kenya, which, together, constitute one of the largest refugee camps in Africa, hosting more than 270,000 refugees in October 2023 (UNHCR, 2023). Some of our main findings include:

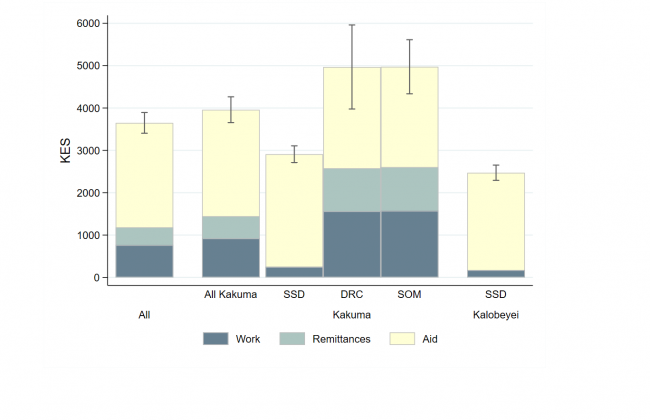

- Refugees remain highly dependent on humanitarian assistance. Only 40 percent of households in Kakuma and Kalobeyei have at least one adult working for an income, and those working earn only 5827 KES ($49) per month on average (Figure 1).

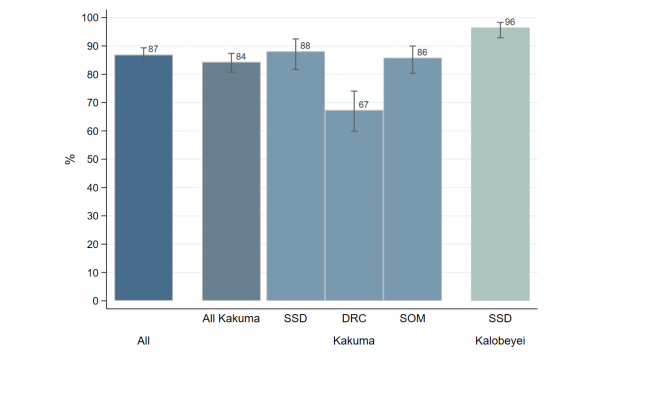

- 87 percent of households had contracted a debt with their food retailer (Figure 2). The average value of debt to food retailers is 6850 KES ($57) per person among South-Sudanese households in Kalobeyei and 1380 KES ($12) per person across all sampled nationalities in Kakuma.

- Debt levels have dramatically increased since 2019. For South-Sudanese households in Kalobeyei Village 3, the average value of debt quadrupled over the four-year period, from an average of 2034 KES ($17) per capita in November 2019 to 9667 KES ($81) in September 2023.

- Lack of livelihood opportunities, low levels of assistance, increasing prices, aid delays, aid cutbacks, and shocks all play a role in the creation and continuation of debt.

- While there is no explicit interest rate associated with credit from shopkeepers, indebted households pay an implicit interest rate through higher prices: indebted customers face prices that are 16 percent higher on average compared to prices with cash.

The report highlights that the debt situation in Kakuma and Kalobeyei is complex and multi-layered. On the one hand, debt is a life-saving coping strategy for many households. On the other hand, debt has financial and psychosocial costs in the medium run and long run. Our report concludes that, to be effective, policy solutions should try to simultaneously reduce the prevalence and levels of debt, address the causes of indebtedness, and mitigate the negative consequences of debt.

Note of the authors: The period covered by the report goes from October 2022 to November 2023. Our research does cover the ration cuts that occurred in July 2023, but not the ration cuts that occurred in May 2024. More information on the dramatic impacts of these additional cuts can be found here.